The Rise of Prop Firms for Retail Traders

Trading is one of the toughest careers to break into and the best prop firms won’t take just anyone. Most retail traders struggle with limited capital, emotional pressure, and the inevitable blowups that come from risking money they cannot afford to lose. Proprietary trading firms, or prop firms, have become the bridge between ambition and opportunity.

Instead of risking your own life savings, you can prove yourself in an evaluation and, if successful, trade the firm’s money. The idea sounds almost too good to be true: low entry cost, access to large trading accounts, and the chance to keep the majority of profits. But here’s the reality: not all prop firms are created equal. Some design rules so tight that even the best traders will fail, while others genuinely want to see retail traders succeed.

This article is the ultimate 2025 guide to prop firms around the world. We’ll cut through the marketing noise, explain the rules, and highlight which firms have the most realistic conditions for passing and staying funded. Whether you trade Forex, Futures, or even Stocks, this is the go-to list of prop firms for retail traders who want a real shot.

What Makes a Prop Firm Worth Your Time?

If you’ve researched prop firms, you’ve seen the endless promises: instant funding, 90% profit splits, million-dollar accounts. It all sounds incredible, but the details matter.

When comparing firms, there are five core rules that will make or break your chances:

Drawdown Rules – Best Prop Firms

Daily and overall drawdowns are the most important risk measures. If a firm only gives you 3% daily and 6% overall, one bad day can wipe you out. The best firms in 2025 offer at least 5% daily and 10% overall drawdowns, giving retail traders space to work with natural market swings.

Profit Targets – Best Prop Firms

A target of 10% in 30 days is a huge hill to climb. Add in tight drawdowns, and it becomes statistically unrealistic. A fair target is 8% for Phase 1 and 5% for Phase 2. Anything lower gives you an even better chance, but anything higher is often a trap.

Time Limits – Best Prop Firms

Many prop firms force you to trade a minimum of 10–20 days in the challenge. That sounds reasonable, but it forces you to overtrade even when markets are quiet. The most retail-friendly firms have no time limits or very short minimum trading days (like 3–5).

Allowed Strategies – Best Prop Firms

Retail traders win in different ways: some scalp, some swing trade, some use EAs. A good prop firm will allow you to trade the way you like, including holding positions overnight or through news. Watch out for firms that ban entire strategies without explanation.

Payouts and Transparency – Best Prop Firms

The final piece of the puzzle is how fast you get paid and how transparent the firm is. If you can only withdraw every 60 days, or the payout system is slow, that’s a red flag. The best prop firms pay weekly or biweekly with no hidden obstacles.

The Best Prop Firms for Retail Traders in 2025

FTMO – Best Prop Firms

FTMO has been the gold standard of prop firms for years, and in 2025 it still stands strong. Their model is clear: a two-phase challenge with a 10% profit target in Phase 1 and 5% in Phase 2. The drawdowns are set at 5% daily and 10% overall.

What makes FTMO respected is consistency. They don’t suddenly change rules mid-challenge, they provide solid support, and they’ve built a global community of traders who can back up their credibility. The challenge isn’t the easiest, a 10% target with limited time pressure can be tough, but for serious retail traders, FTMO remains a trusted benchmark.

My Forex Funds (MFF 2.0) – Best Prop Firms

After shutting down in 2023, My Forex Funds has returned under new structure. Their 2025 reboot is designed to restore trust. While the core evaluation is similar to FTMO, MFF 2.0 is experimenting with more flexible targets and faster payouts. This makes them a strong contender again, especially for traders who thrived in the original program.

The big question for retail traders will be how stable their new rules are over the long run. For now, they offer competitive pricing, broad instrument access, and a familiar format that many traders already know how to approach.

The 5%ers – Best Prop Firms

Not every trader wants to grind through challenges. That’s where The 5%ers stand out. They offer instant funding accounts alongside challenge models. Profit targets are lower, often in the 6–8% range, and their scaling model grows accounts steadily if you show consistency.

For a retail trader who wants to avoid the stress of strict deadlines, The 5%ers are among the easiest firms to get started with. Conservative traders who prefer lower risk strategies will find the rules especially forgiving.

Topstep – Best Prop Firms

Topstep is the pioneer of futures prop trading. Instead of forex pairs or CFDs, Topstep focuses on instruments like E-mini S&P 500, Crude Oil, and US Treasuries. Their evaluation rules are fair: realistic profit targets, clear daily loss limits, and no unnecessary restrictions.

What makes Topstep unique is their long history and credibility. They’ve survived while other firms have disappeared. For retail traders who prefer regulated futures markets over forex, Topstep is one of the most achievable pathways to long-term funding.

Apex Trader Funding – Best Prop Firms

Apex has exploded in popularity for futures traders thanks to its low entry fees and aggressive discount promotions. Their accounts range from $50K to $300K, and while they use a trailing drawdown model that can feel tight, the cost of re-entering challenges is so low that many retail traders find them worth the grind.

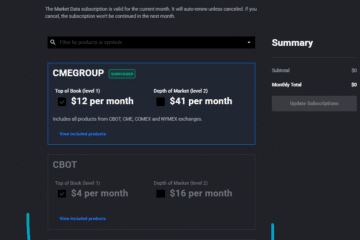

For a retail futures trader, Apex is the affordable way to test yourself repeatedly until you find consistency. Their scaling model and wide availability of contracts make them a powerful choice in 2025. Here’s a tutorial on setting up Apex Trader Funding.

Funded Trading Plus – Best Prop Firms

This firm is gaining serious momentum because of one rule: no time limits. That single condition removes the number one pressure point for retail traders. Instead of forcing trades to meet a deadline, you can wait for your setups, manage risk properly, and pass at your own pace.

Profit targets are a reasonable 8% for Phase 1 and 5% for Phase 2. Daily and overall drawdowns are set at 5% and 10%, which is in line with trader-friendly industry standards. For anyone tired of blowing challenges due to deadlines, Funded Trading Plus is arguably one of the most passable prop firms in the world.

E8 Funding – Best Prop Firms

E8 Funding has earned its reputation as one of the easiest mainstream firms to pass. Their evaluation targets are set at 8% and 5%, with daily drawdown at 5% and overall drawdown at 8%. That lower overall risk requirement makes their structure more forgiving than the standard 10% model.

On top of that, E8 offers large account sizes and a streamlined dashboard. Retail traders who want the best balance of targets and drawdowns should keep E8 at the top of their list in 2025.

Fidelcrest – Best Prop Firms

Fidelcrest offers flexibility in account types, from Micro to Pro, with profit targets ranging from 5–10%. Their main appeal is in huge scaling potential, accounts can grow into the millions if traders perform consistently.

The downside is that their stricter rules on drawdown and trading style can be challenging. For retail traders who aim high and want the prestige of million-dollar funding, Fidelcrest is worth considering, but it’s not the easiest road.

Personal Experience: Fidelcrest don’t always honour it when you pass their challenge. They have a lot of hidden rules which come out after the fact. This is not honourable in my opinion.

FundedNext – Best Prop Firms

FundedNext has made a name for itself by offering payouts from day one on funded accounts. Traders don’t have to wait weeks or months, they can see results almost immediately.

Their profit targets (8% and 5%) and drawdowns (5% and 10%) are fair, and their evaluation models often include no time limits. For retail traders looking to generate consistent withdrawals without endless hoops, FundedNext is one of the most practical choices in 2025.

Bright Funded – Best Prop Firms

Bright Funded is a rising firm in 2025. With fast payouts, generous profit splits, and targets aligned with retail traders’ capabilities, it’s quickly becoming a popular alternative to FTMO and E8.

The key advantage here is reputation. While Bright Funded is newer, early reviews suggest that its rules are transparent and realistic. For traders who like to get in early with promising firms, Bright Funded is worth watching.

True Forex Funds – Best Prop Firms

True Forex Funds keeps things simple. Their evaluation uses the industry-standard 8% and 5% profit targets with 5% daily and 10% overall drawdowns. There are no major restrictions on strategies, making it a straightforward alternative to FTMO.

For retail traders who want a “no surprises” prop firm, True Forex Funds is one of the cleanest and most transparent setups available.

Lux Trading Firm – Best Prop Firms

Lux positions itself as a professional development prop firm rather than a mass-market challenge provider. Their profit targets are lower, often around 4%, but they emphasize long-term growth and capital allocation.

For retail traders, this is one of the easiest paths in terms of passing rules, but it requires patience and discipline. Lux is a great choice for traders who see prop funding as a career rather than a quick cash grab.

OFP Funding – Best Prop Firms

OFP Funding stands out by focusing on crypto alongside forex. Their one-phase challenges give retail traders a faster route to funding, and the rules are generally retail-friendly. If your edge is in crypto, OFP may be one of the few firms where you can apply it seriously.

OneUp Trader – Best Prop Firms

OneUp is another futures-focused firm with a simple one-phase evaluation. Profit targets are modest (6–8%), and their rules are among the most achievable for retail futures traders. If you want to avoid multi-phase processes, OneUp is a strong candidate.

The Funded Trader (TFT) – Best Prop Firms

The Funded Trader leans heavily on branding and community, but behind the marketing, it offers a standard 8% and 5% two-phase challenge. Their rules are similar to FTMO, though sometimes with more gamified elements.

For retail traders, the passability is medium. It’s not the easiest firm, but it does have a large support network and community appeal.

Other Notable Firms

- BluFX: Instant funding via subscription model, no challenges. Easy entry but very tight risk controls.

- Leeloo Trading: Futures funding with affordable evaluations.

- Alpha Capital Group: UK-based, fast-growing firm with global reach.

- Trade The Pool: Specializes in stock market prop trading.

- FXIFY: Forex-focused prop firm with aggressive scaling.

Which Prop Firms Have the Most Passable Rules?

When it comes to actually passing the evaluation and getting funded, the rules make all the difference.

Based on targets, drawdowns, and time requirements, the most retail-friendly firms in 2025 are:

- Funded Trading Plus, no time limits, realistic targets.

- E8 Funding, lower overall drawdown target.

- FundedNext, day-one payouts, flexible rules.

- The 5%ers, instant funding with conservative growth.

- Topstep / Apex, best for futures traders.

These firms give retail traders a fair shot at proving themselves without setting impossible conditions.

How to Choose the Best Prop Firms

There’s no such thing as best prop firms in general. The best one for you depends on your trading style. If you want flexibility, look at Funded Trading Plus or FundedNext. If you trade futures, Topstep and Apex are unmatched. If you want long-term growth, The 5%ers or Lux Trading Firm are ideal.

The important thing is to match your personality to the rules. If you’re disciplined and consistent, choose a firm that rewards patience. If you’re more aggressive, go for firms with cheaper challenges and easier retries.

Prop firms have opened the door for retail traders to trade large accounts without risking personal capital. In 2025, there are more opportunities than ever, but also more noise. Stick with the firms that offer transparent, realistic rules, and you’ll give yourself the best chance of building a funded trading career.