Wouldn’t it be good to buy things and not stress about it? Looking after your money will help you to achieve your goals and be more relaxed about every purchase you make. Staying in budget also helps you draw the line and say ‘no’ when you are about to spend money on something that is not in your budget. While there’s not much education in many schools about budgeting, there are some great tools out there to help you make the most out of every dollar you earn.

Here’s a few things you will need to create a great budget for you to stick to:

A way to track your finances

Either a spreadsheet (downloadable template provided) or an app (I use PocketSmith) will help you to track your income and expenditure, and even plan the future.

An App can make it so much easier to keep everything up to date.

The pros for a spreadsheet is that you can set your budget and track your spend however you like. The downside is that you have to update each transaction manually and also learn how to use excel. Excel is a good way to keep track of things and quickly map out your needs.

If you’re after something easy to keep updated that won’t take much time and will give you awesome reports each month, PocketSmith links directly to your bank accounts in a similar way to how businesses keep their financial records. Once you outline how you want to categorise transactions, all you really have to do is set the category they fit into (for example, fuel will go into a fuel or car category).

Once you know where you will put your data, you need to understand what you will be putting in there and it’s purpose. We also have a COMPLETE and FREE TUTORIAL budgeting using on this app.

The Budget

A budget is a tool you use to stay on track with your finances so that you know where you stand financially at any time. It helps to reduce stress and improve your decision making when buying things. A budget can be fairly simple, as it only needs to consist of two major things: Income, and Expenses. The idea of a budget is to work out how much you can spend without spending more than you earn. Many people will make a budget weekly or monthly as it is easier to keep track of overspending on smaller time periods before it gets out of control.

Income – Using the Income part of your budget

This is the expected incoming transactions where you are getting paid. This can be from a job, a business or however you earn your money. Income is important as it gives you an idea of how much you can spend without going into negative, so it helps give you an idea of what your expenses can be.

Expenses – Using the Expenses part of your budget

I separate my spending into two major categories, one is necessities such as bills, housing and food. The other relates to other expenditures and I call that ‘Extras’. The way I decide on whether something is a necessity or not is to consider its importance with the question, ‘will I die without this, or will it reduce my income by more than its cost?’. For example, a phone bill is not life or death, but it’s likely income would reduce and opportunities could be missed by not being contactable. Electricity is also a necessity as it helps to reduce the time spent on certain tasks, increasing potential income and making further education easier. And of-course there’s food, which if you don’t eat…

Extras are pretty much everything else, from clothing, social event costs, eating out and anything fun.

Other Tips and Tricks

Many people create a budget for what they can see right now, but then a bill might come through that they weren’t prepared for. Mapping every likely expense for the year can really help you reduce any surprise bills and make sure your net wealth increases each year. Things that often fall under the radar include electricity and water bills, rates, car registration, car servicing and various other bills that are annual.

Other things to think about adding to your budget are gifts (like Christmas time and birthdays), and other events like concerts and festivals. These types of things can often throw peoples budgets out, so factoring them in will really help you stay on track without being tight and excluding fun from your life.

Be sure to budget some savings or investment funds for something like listed shares or Raiz so that you have a buffer for unexpected events and opportunities.

It’s not always about tightening up your spend, increasing your income should always be a priority when it comes to budgeting. Always put money towards some education so that you stay ahead of the employment market and businesses. The more skills you have and the more you can do will be critical to your long-term success. While you may not want to enter into a formal degree with a university, there’s some amazing courses out there on Udemy for almost any skill you could think of, the only limitation is your ability to search. Boosting your income is a great way to keep your budget in check. Consider the time when there was an opportunity out there but you didn’t have the skills to take it up. If you have the skills, all you need is the opportunity which will come if you put some effort into it.

Accountants often deal with budgets in their day to day activities. A budget needs to be conservative and overestimate spend slightly to account for future changes in market conditions and inflation. It is much better to have more than you expected at the end than to have less. It might only be a few dollars per item or category each period, but that will add up over time providing a buffer.

One of the best books you can read about personal finance is called The Barefoot Investor by Scott Pape. It covers a range of tips and tricks on how to best build up your savings and give yourself a more certain financial future.

Spending Habits

People love monthly payments and finance options. They make cashflow easier to deal with and can allow you to get what you want sooner rather than later. Finance options often come with interest or other fees which can create a real drag on your long-term finances. To work out how much monthly things are costing you, and how much true interest you are paying, follow the steps below:

Work out the total current cost over 12 months, including fees (or whatever period you are working with).

Now work out the total cost of paying something upfront (things are often at a discount to a finance option).

Let’s use insurance as an example:

You currently pay car insurance for $65 per month, which adds up to $780 per year.

The annual payment for insurance is $600, which works out to be $50 per month, saving you $180 per annum ($780 – $600). Companies like you to pay upfront because they can use your money to make more money. This is an important thing to consider for yourself as well. See below:

You save 30% (180/$600 =30%) by paying up front. When weighing up your best option, you can now consider how much you will earn by keeping that money and paying monthly. If you think you can earn more than 30% per annum and pay monthly, you would be better off paying monthly and investing the money. Most returns are less than 30% per annum so it’s likely you are better off paying the insurance up front in this case.

Let’s say the saving was only 2% by paying up front. There’s a good chance there are investments that will return more than 2%, meaning paying monthly and investing the funds into something with a return higher than 2% would be more worthwhile.

Another example is a car loan

A car loan might only be 8% interest, but then there’s often fees on top of that. If the fees are $20 per month, then that will make the effective cost of having a loan much higher depending on the loan value. For example, if your car loan was $3000 and the interest was 8% (making interest for the year of $240 (8%), but there was a monthly fee of $20 ($240 per year), the effective interest rate would be 16% ($240 of actual interest plus $240 in fees, dividing this total by $3000 to get 16%).

Paying Down Debts

When paying down debts, target the biggest effective interest rate items. If the insurance is an extra 30%, but your car loan is an extra 16%, you would pay the insurance first if you have the cash.

I hope these tips and resources really help you get into a better financial position but if they have not, then I really recommend you read a book called The Barefoot Investor – The Only Money Guide You’ll Ever Need. On the flip side if you are looking to learn a heap more about investing, let us know in the comments below as if you ask, we will create amazing content for you to learn what we have, but way faster.

Look The Other Way!

While saving is great, budgeting becomes less stringent when you have higher income, so while focusing on a budget is great, it is important to work towards increasing the income side and keep the expenses the same or lower. In fact, if you have more buying power you can often buy in bulk saving money by buying more than one of the item you need and making it last longer.

Of course making more money isn’t as simple as that so here’s a few resources that will help with that. The first is a simple online business tutorial page which covers great info on the general rules of online business and how to get things going. It also covers the skills you should be working on to be successful.

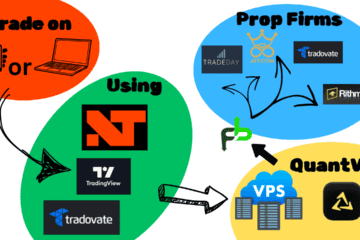

An online business can be a ton of work, and there’s no certainty around whether it will pay off or not… There’s a way you can make money from home, online and it is by trading, and there’s a free course over at Global Finance Trading Course. Trading is the act of placing an order direct to the market and if it works out, you get the profit. No customers, no marketing, no other hassles. Sounds great right?

Best Money Management App 2021

Either a spreadsheet (downloadable template provided) or an app (I use PocketSmith) will help you to track your income and expenditure, and even plan the future.

An App can make it so much easier to keep everything up to date.

App That Helps You Budget

Once you start categorizing your payments, you will be able to look back and see how your spend has been tracking and where you can easily make changes over the period of a year. A year is a long time when it comes to spending, and a slight shift in your yearly spend can mean big dollars to go towards travel, investing and anything else that you want to spend it on! The Pocketsmith App is an app that helps you budget, can be easily used on an android phone via the play store, it can also be easily used on an iPhone via the Apple Store to help you budget on the go with ease.

Best Budget App Free

I do admit, I started using PocketSmith free version. Yes, they offer a free version where you manage your finances at no cost at all. I quickly realised though, that I would not stick to it. And as I have searched all over the place for apps that allow an easy way to track finances over time, excel is probably just as easy as any other. I have provided a spreadsheet up higher in the article, but if you are after a free budget app to manage your finances, then PocketSmith is a good way to go.

My honest opinion of the free version, it’s good. But I knew I wouldn’t stick to uploading my transactions, so I quickly added the monthly plan (the middle option on the PocketSmith site). I now have many months of financial data, beautifully compiled into easy to read charts and statements. I know exactly what I have spend, where, when and what could have been done to save more.

What has it done for my personal finances?

Now that I have a solid set of data, I can finally look over my finances and be 100% certain of where my money has gone. That allows me to make better financial decisions, adjust and adapt without question. The data is there, it is all allocated and all I have to do is make the decision on where my money should be going.

Making changes in life can be challenging, making good financial decisions often slips away from us. But why is this so?

Many of us don’t have the hard financial data to back up our decisions, so its all too easy to say yes to everything now in spite of our future. To deal with things later, rather than know what’s coming and prepare appropriately. While it’s easy to make decisions with money you have now, you can jeopardize your future decisions and put future you into a hole.

Your future you, will say thank you to your past self, when you use PocketSmith. Better financial decisions, you can’t question where all your money is going, because you already know the exact answer. Do it for future you! You will thank past you later on, when you can make the decisions that you financially cannot make now. Get it now and thank yourself later.

0 Comments