Finding the Right Broker

Finding the right broker means understanding what you are looking for in a broker. Do you need access to certain markets, leverage, trading platforms or to trade through structures such as trusts or companies? If you know what you are looking for from the above questions, it will make it easier to decide.

Starting Out Small

You could be just getting started, which is fine and an easy option is to go with Pepperstone. They are a reliable firm that provide access to a wide range of assets, leverage, platforms and structures which you can trade through. They also have the ability to trial a demo account and experience exactly what it is like to trade.

Structures (Personal, Company SMSF)

If you are using an SMSF to trade, you may find you have to use a certain broker to comply with your super’s requirements. If you are wanting to use a company to trade and invest, Etoro is not a good option as they only seem to allow individuals with an account. Most regular brokers allow a range of structures to trade with though.

Leverage Types

Some brokers allow different types of leverage, whether it is a margin loan or margin on derivatives and CFD’s. Some brokers offer more leverage than others depending on their risk appetite and regulations. The amount of leverage available often depends on the asset type.

Types of Broker

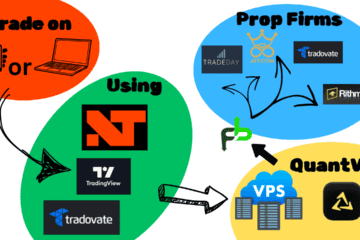

Brokerage firms aren’t always there to simply deposit your own money and trade. There are also companies that allow you to pass tests to gain access to capital to trade with. These are called Prop firms (Proprietary Trading Firms). They invest in traders and in turn receive a portion of the returns from trading. The trader can keep their portion of the profit provided they are in line with the trading rules set out by the firm.

Broker Platforms

Brokers often use different platforms to trade with. A platform is simply software that allows market data to be traded by a trader, through the broker. Common platforms include Metatrader 4 and 5, CTrader, Web based trading platforms (often unique to the broker) and there are many more out there to. I like to use MetaTrader as it is customizable and there is plenty of training available on how to use it. Brokers will generally show on their website what platforms they have access to.

Choosing the Right Brokerage Firm

Once you understand what type of broker you are looking for and what they need, it is time to refine the firm you think will work best for you.

What to Look For in a Broker

There are a few important things a broker needs to have. Be warned, some brokers are not legitimate and could keep your money! Stick to brokers with AFSL Licenses that are regulated by ASIC. This information can be found on their website. You also want to trade with brokers that are financially stable so that they don’t go broke. This has happened in the past to a number of companies, often following major investment events and crashes.

The payment options that are available are often important. You want to make sure you can trade the assets you want to use, some brokers may only have access to Foreign Exchange so if you want to trade Indices this would be an issue.

Ensuring they meet everything you need and they are regulated, you can test them out by starting with a small amount, working with their support team to see if they are helpful or not. Any company that doesn’t want to allow a withdrawal is not a good one in my opinion.

What to Avoid with Brokers

Avoid brokers without regulation, poor support, or don’t want to provide a withdrawal (always start small if it is a new broker). Also stay away from any pushy sales people that want you to add more money in. The moment there is a noticeable thirst for my cash I am concerned. I also like to trade with companies in my own country, however there are a few exceptions such as funded trading accounts, which as long as they pay up, it doesn’t matter too much.

Assessing Broker Reviews Realistically

Every company in the world has bad reviews. Financial companies often cop a lot of slack from disgruntled people that don’t know what they are doing and lose money. Be very wary of these people and their reviews, they are often filled with spelling errors and bad grammar. The often also outline that they have over risked their account or have a limited understanding of financial markets. If you don’t have an understanding of things like risk, get training first. Don’t be the angry reviewer that didn’t put in the effort to be a good customer. And don’t let bad reviews scare you off on face value. Have a look at what was written and if it is properly written and the fault of the company then take notice.

The Brokers I Use and Why

Pepperstone is the broker of choice for most things, while there are a couple of companies that offer funding to traders that can pass their tests. These funded brokers (Prop Firms) are The Prop Firm Australia and FTMO (based overseas).

Pepperstone has provided good support and everything I need for years. I have used many brokers for different reasons however Pepperstone has been one of the most consistent providers around. The funded trading accounts are due to the rules that are in line with my trading plan which will be in another article, as there is a bit more to it.

Choosing the Right Forex Broker

Choosing the right Forex broker is a matter of assessing all of the steps above and making a good decision for you. If you are still unsure, you probably need to go through more training, or perhaps bite the bullet and choose one to start trading with.

Trading Lessons

If you are at the stage where you are unsure and want help, there are training providers around that can help. Send me an email and I can assist you further and point you in the right direction.

0 Comments