Manara results after trading for 6 hours on a live account. Almost a constant flow of trades on forex and other instruments. This full guide shows you how to access the Manara trading tool and how some people are using it in their trading.

Watch the video below for results and strategy used to get it. For more on how to get access, this page takes you through the entire setup process.

Manara Trading Setup (how to guide)

To set up manara trading tool you first need to access the Eaconomy membership. To access the Eaconomy membership you first have to have an invite link (provided below) and it will take you to a page that looks like the screenshot to the right.

Accessing The Eaconomy Portal

Once in, you will either be taken into the Eaconomy portal, but usually you will access the portal by heading to the home page for Eaconomy. It looks like the screenshot to the left.

Placing the Order for Manara Access

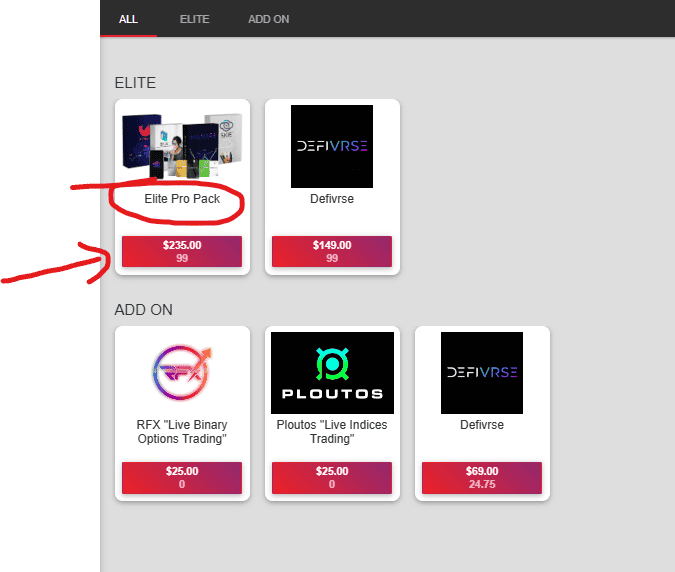

Once you are in the portal, you will need to go to the side panel and click Orders, then Purchase an Order. This will take you to an area where the products and packages that Eaconomy offer are available to buy.

Where to Buy Elite Pack Eaconomy

The Elite Pack in Eaconomy contains the Manara trading Tool access. Once you have made the purchase you will be able to go to the next step and start using the Manara Trading Tool straight from your browser. No downloads required.

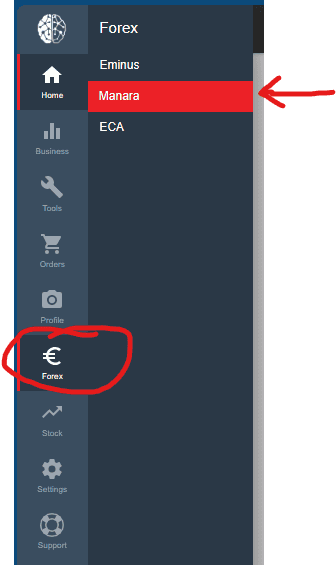

Find the Manara Pattern Tool

The Manara pattern tool can be found in the Eaconomy portal also (once you have purchased the Elite Pack). To access the Manara tool, head to Forex in the side panel menu, then click on Manara.

The next page you will see once you click on the Manara is shown below. You can set your security pin (see headers of page in screenshot below) and then you are able to utilize the manara trading tool, see patterns and use the information as part of your analysis.

Once you are in the Manara Tool browser area, you will be asked for a PIN which you should have either set or can go to the previous page and set it up.

You can now access the Manara Trading Tool. There’s notifications that come through quite frequently, so if you’re available to check it, there’s a good chance there will be something valid to investigate further and perhaps trade if it suits your strategy and market opinion.

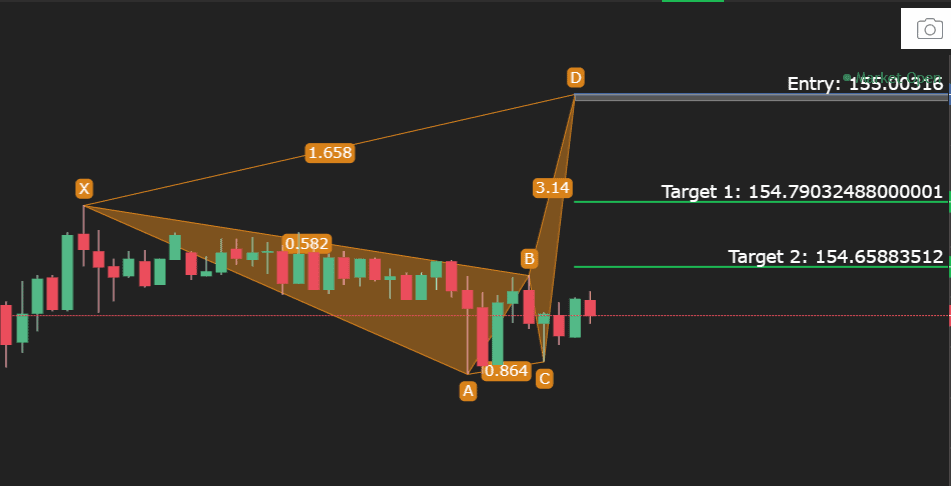

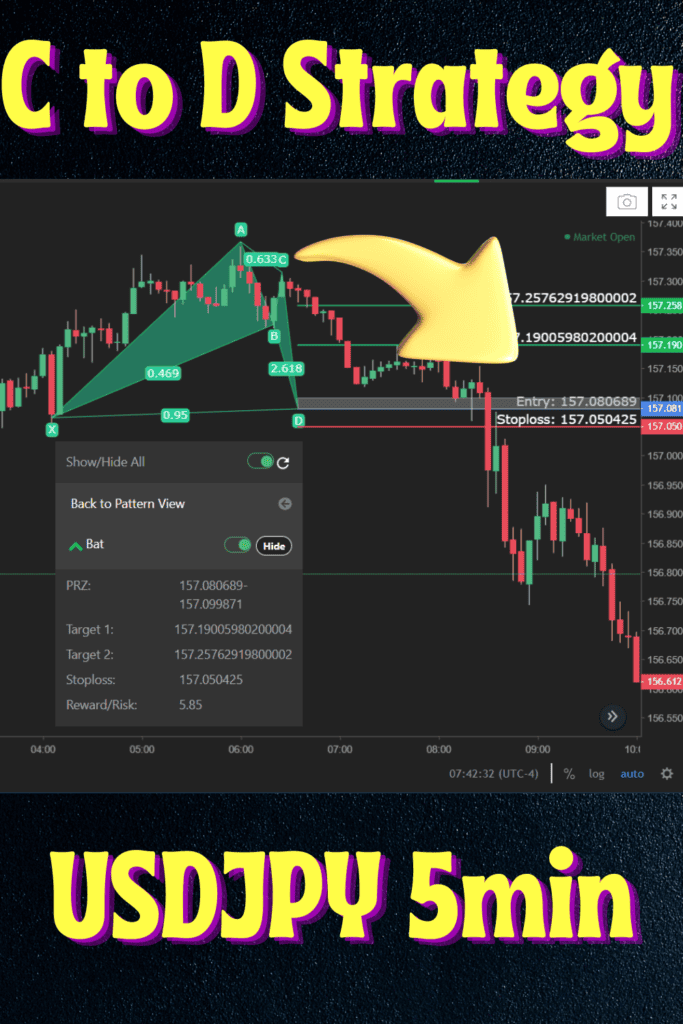

The manara example above shows the notification button, which is where you can see new patterns that are forming and ready to review. You can also see the C and D points (explained in the video at the top of this page). To the side there’s a panel that explain the risk reward of the trade based on the entry provided, however as per the video at the top, some traders are making use of the Incomplete pattern. This is due to the fact that patterns are expected to reach their final point (point D) from point C, so stacking a probability of direction, traders are jumping in early to make the most of this tool.

This example was of the USDJPY on a 5 minute chart, which is underlined red.

Why Use a Pattern Trading Tool?

Scanning the markets manually can be tedious, time consuming and even frustrating. Even if you were writing your own programs, it may be difficult to pick up all of the patterns that are showing up for the Manara trading tool.

A pattern trading tool makes trading easier, provides more setups to consider and takes some of the pressure off the analysis process.

Patterns form due to the buying and selling of the financial instrument which is based around a number of factors including supply and demand. As the measurements of certain pattern types play out, the Manara Trading Tool notifies you of the setup which is approaching so you can see if you want to trade it.

At the click of a button, you can open up a chart with the pattern already drawn on it.

Still not convinced, check out the Eaconomy reviews talking about the Manara Trading Tool.

Pattern Trading Strategies

Complete Pattern Forex

One pattern trading strategy is to wait for the pattern to complete (often at D point on Manara tool), then the tool gives you entries, stops and targets, along with an expected risk reward ratio.

Incomplete Pattern Forex

Incomplete patterns offer potential setups to trade too, since it is anticipated they will reach the D point, from C point as explained in the video. You can see in the example screenshot, the pattern was quickly moving towards the D point so it is important to keep an eye out for new notifications on the Manara Tool to catch these incomplete moves.

Mean Reversion Patterns

If you are more advanced and want to spread out your risk a little more, a mean reversion of a pattern could be a way to trade multiple symbols based of the one pattern setting up.

If you have correlated or inversely correlated forex pairs or other markets, you could trade both of them at the same time, aiming for a mean reversion, a term used to describe a ‘meet in the middle’ approach where one symbol is expected to go up while the other goes down. Closing both trades in a net overall profit is the goal, knowing that one may lose a little bit of money potentially. On the flip side, you can be a little more protected from market fluctuations if you understand the effect of correlated global markets.

Pattern Scalping

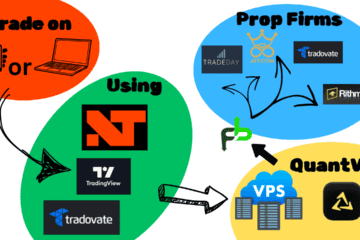

Many traders might look to scalp markets using the key pattern levels on both complete or incomplete patterns. Particularly those trading with a prop firm like Apex Trader Funding where they generally don’t want to hold positions for a long time. This can be advantageous when used in conjunction with a Depth of Market (DOM) to read the order flow, particularly around those key pattern levels.

Entries for Carry Trades

If you trade on your own account and are able to simply hold positions, some traders like to trade longer term for a carry trade. A carry trade is when a trader seeks to benefit from the positive swap (overnight rate) paid to you by the broker for some currency pairs and instruments. It’s easy to check this in the symbol properties area of the platform, and see if there is a positive swap for the symbol you want to trade.

Combining this concept with a pattern tool can help get a double whammy and gain more of an advantage by using the swap payments and the expected movement of the pattern to take you into a trade and potentially hold it longer term.

0 Comments